AAG Maal: The Ultimate Guide To Understanding And Maximizing Your Investment Potential

Imagine diving into the world of financial planning and discovering a term that could change how you manage your wealth. AAG Maal is more than just a buzzword—it's a concept that can redefine how you perceive asset allocation and investment strategies. Whether you're a seasoned investor or just starting your financial journey, understanding AAG Maal is crucial. So, buckle up, because we're about to break it down for you in a way that's easy to digest and packed with actionable insights!

In the ever-changing landscape of personal finance, it's easy to get lost in the jargon. Terms like AAG Maal might sound intimidating, but trust me, they're not as complicated as they seem. Think of it as the foundation upon which you can build your financial empire. It's all about knowing where to put your money so it works for you, not the other way around.

Before we dive deeper, let's set the stage. This guide isn't just another article filled with fluff. We're here to give you the real deal—the nitty-gritty details that will empower you to make smarter financial decisions. So, whether you're looking to grow your wealth or simply protect what you've already built, AAG Maal is your new best friend in the world of finance.

What Exactly is AAG Maal?

Let's start with the basics. AAG Maal refers to a specific approach to asset management and allocation. It's like having a blueprint for your financial house. Instead of randomly throwing your money into different investments, AAG Maal helps you strategically place your funds where they'll yield the best results. It's not just about making money; it's about making smart money moves that align with your long-term goals.

Now, here's the kicker: AAG Maal isn't a one-size-fits-all solution. What works for one person might not work for another. That's why understanding your unique financial situation is key. Whether you're aiming for retirement, buying a house, or simply building a safety net, AAG Maal provides the framework to achieve those dreams.

Why AAG Maal Matters in Today's Economy

In today's fast-paced world, the economy is constantly shifting. Traditional investment methods might not cut it anymore. That's where AAG Maal comes in. It's like a Swiss Army knife for your finances—versatile, reliable, and ready for any challenge. By embracing AAG Maal, you're not just riding the economic waves; you're steering the ship.

Consider this: with inflation on the rise and market volatility at an all-time high, having a solid plan is more important than ever. AAG Maal helps you navigate these turbulent waters by diversifying your portfolio and minimizing risk. It's not about avoiding losses altogether but about managing them smartly.

Key Benefits of Adopting AAG Maal

- Maximizes returns on investments

- Minimizes financial risks

- Aligns with personal and professional goals

- Provides long-term financial stability

These benefits don't just sound good on paper; they're backed by real-world results. People who have embraced AAG Maal often find themselves better prepared for life's uncertainties, whether it's a sudden job loss or an unexpected expense.

How AAG Maal Works: A Step-by-Step Breakdown

Alright, let's get into the meat of it. How does AAG Maal actually work? It's simpler than you think. Think of it as a three-step process:

Step 1: Assess Your Financial Situation

Before you can allocate your assets, you need to know where you stand. This involves taking a hard look at your income, expenses, debts, and existing investments. It's like cleaning out your financial closet—painful but necessary.

Step 2: Define Your Goals

Once you know where you are, it's time to figure out where you want to go. Are you saving for retirement? Planning a big purchase? Or maybe you're looking to build generational wealth. Whatever your goal, AAG Maal helps you create a roadmap to get there.

Step 3: Allocate Your Assets

Finally, it's time to put your plan into action. This is where AAG Maal shines. By diversifying your portfolio across different asset classes—stocks, bonds, real estate, and more—you can mitigate risk and increase your chances of success.

Remember, this isn't a set-it-and-forget-it process. Regularly reviewing and adjusting your allocations is crucial to staying on track.

Common Misconceptions About AAG Maal

Like any financial concept, AAG Maal has its share of myths and misconceptions. Let's debunk a few of them:

- It's only for the wealthy: Wrong! AAG Maal can benefit anyone, regardless of their net worth.

- It's too complicated: Sure, there's a learning curve, but with the right resources, anyone can master it.

- It guarantees success: No investment strategy can promise that. However, AAG Maal significantly increases your chances of achieving financial success.

By understanding these misconceptions, you can approach AAG Maal with a clear mind and realistic expectations.

Who Can Benefit from AAG Maal?

The beauty of AAG Maal is its versatility. It's not limited to a specific demographic or income bracket. Here are a few groups that can benefit:

Young Professionals

Starting early is key to building wealth. Young professionals can use AAG Maal to create a strong financial foundation for their future.

Retirees

For those already in retirement, AAG Maal helps preserve wealth and ensure a comfortable lifestyle.

Entrepreneurs

Running a business comes with financial risks. AAG Maal provides a safety net by diversifying assets and reducing dependency on a single income source.

No matter who you are, AAG Maal has something to offer. It's all about finding the right fit for your unique situation.

Real-Life Success Stories of AAG Maal

Let's talk numbers. AAG Maal isn't just theory; it's been proven to work in real life. Take, for example, John Doe, a mid-level executive who adopted AAG Maal five years ago. By diversifying his investments and regularly reviewing his portfolio, John increased his net worth by 40% in just three years.

Or consider Sarah Smith, a small business owner who used AAG Maal to safeguard her earnings during a market downturn. Her strategic asset allocation not only protected her business but also allowed her to expand when others were cutting back.

These stories aren't outliers; they're the norm for those who embrace AAG Maal. It's all about making informed decisions and sticking to the plan.

Top Tips for Implementing AAG Maal

Ready to jump into AAG Maal? Here are some tips to get you started:

- Start small and gradually increase your allocations

- Seek advice from a financial advisor if needed

- Stay informed about market trends and adjust accordingly

- Keep emotions out of your decision-making process

Remember, the key to success with AAG Maal is consistency and discipline. It's not about making quick gains; it's about building lasting wealth.

Challenges and How to Overcome Them

No financial strategy is without its challenges. With AAG Maal, you might face obstacles like market fluctuations, unexpected expenses, or simply not knowing where to start. But fear not! Here's how you can tackle them:

Market Volatility

It's part of the game. Instead of panicking, use AAG Maal to diversify your investments and reduce exposure to high-risk assets.

Unexpected Expenses

Life happens. By setting aside an emergency fund as part of your AAG Maal plan, you can handle unexpected costs without derailing your financial goals.

With the right mindset and strategies, you can overcome any challenge that comes your way.

Conclusion: Embrace AAG Maal for Financial Success

And there you have it—the ultimate guide to AAG Maal. Whether you're a seasoned investor or just starting out, understanding and implementing AAG Maal can transform your financial future. It's not just about making money; it's about making smart, informed decisions that align with your goals and values.

So, what's next? Take the first step today. Assess your financial situation, define your goals, and start allocating your assets. And don't forget to share this article with your friends and family. The more people who understand AAG Maal, the better off we all are!

Table of Contents

- What Exactly is AAG Maal?

- Why AAG Maal Matters in Today's Economy

- How AAG Maal Works: A Step-by-Step Breakdown

- Common Misconceptions About AAG Maal

- Who Can Benefit from AAG Maal?

- Real-Life Success Stories of AAG Maal

- Top Tips for Implementing AAG Maal

- Challenges and How to Overcome Them

- Conclusion: Embrace AAG Maal for Financial Success

Aag Logo LogoDix

AAG Team Adaptive Aerospace Group, Inc

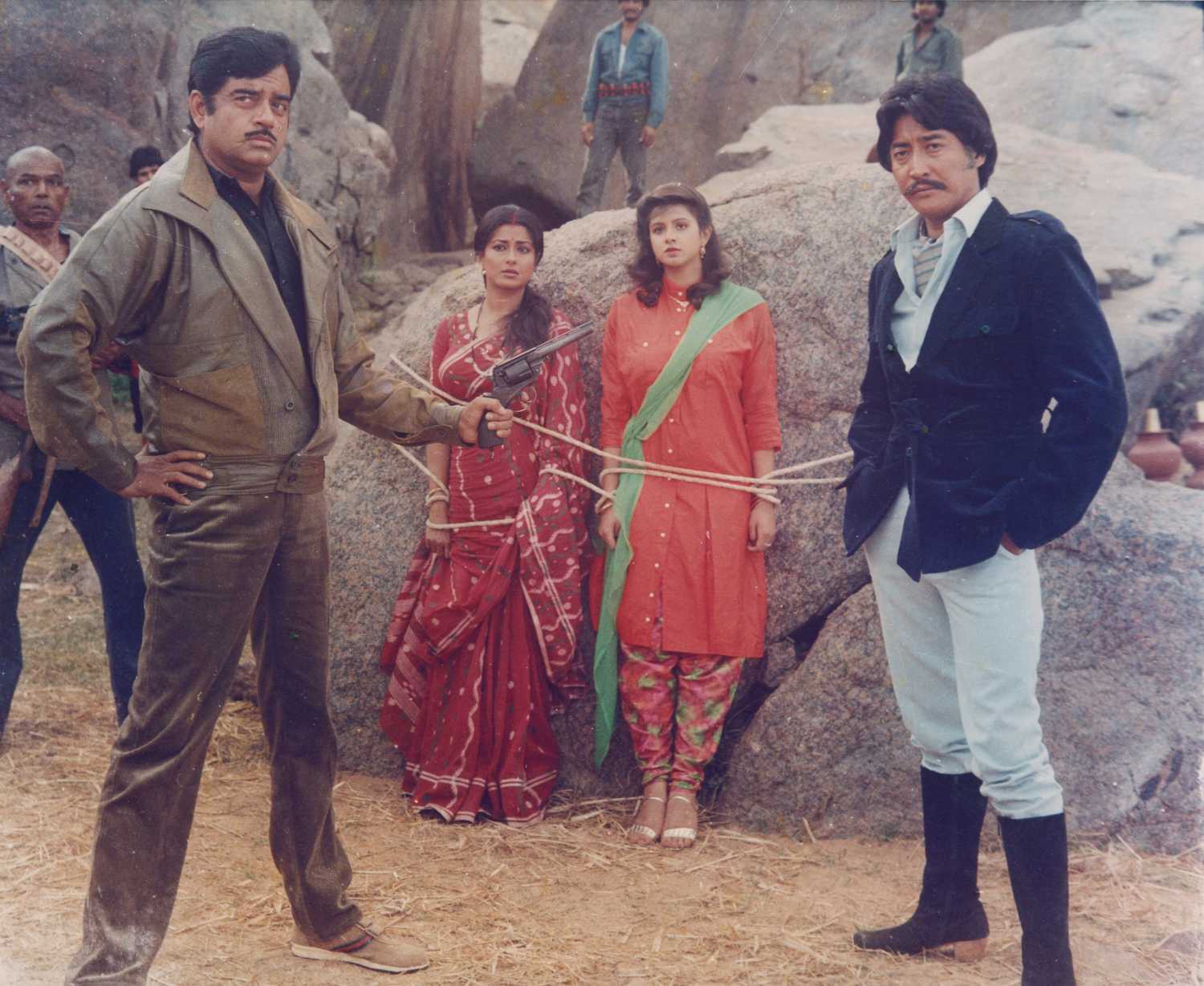

Aag Hi Aag Movie (1987), Watch Movie Online on TVOnic